real property gains tax act 1976 amendment 2019

Government Publishing Office Page 63 BIPARTISAN BUDGET ACT OF 2018 Page 132 STAT. Sinn Féin believes in immigration.

Finance Bill 2021 Proposed Amendments To The Real Property Gains Tax Act 1976 Lexology

2 enforcement authority over any person who at the time of the alleged violation or abuse is or was a member or employee of.

. Thus when an individual seeks to preserve something as private and his expectation of privacy is one that society is prepared to recognize as reasonable official intrusion into that. The initiative was approved by California voters on June 6 1978. A Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020.

Born January 1 1954 is an American lawyer and politician serving as the senior United States senator from New Jersey a seat he has held since 2006. 112240 title I 101a1 Jan. Each amendment made by this title amending this section and sections 24 32 55 and 63 of this title shall be subject to title IX of the Economic Growth and Tax Relief Reconciliation Act of 2001 Pub.

And informally known as Disney Parks is one of The Walt Disney Companys five major business segments and a subsidiary. Disney Parks Experiences and Products Inc formerly Walt Disney Parks and Resorts Worldwide Inc. Amendment Act 2019 46 of 2019 Amended by Finance Act 2020 No.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of goldThe gold standard was the basis for the international monetary system from the 1870s to the early 1920s and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold. As of January 2022 Sinn Féin in Northern Ireland have committed to. 2315 was formerly set out as.

Capital Gains Gains From Alienation Of Property 14. A The Fourth Amendment protects not only property interests but certain expectations of privacy as well. Is a liability of the borrower.

An all-Ireland economy with a common currency and one tax. And C was incurred before February 15 2020. B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit organization which employs not.

929E Amends the Securities Exchange Act of 1933 the Investment Company Act of 1940 and the Investment Advisers Act of 1940 to expand SEC enforcement and remedies to include. 2 2013 126 Stat. Proposition 13 officially named the Peoples Initiative to Limit Property Taxation is an amendment of the Constitution of California enacted during 1978 by means of the initiative process.

100 Section 2 eff January 1 2014. From 1976 there was a. In Anglo-American common law the party who entrusts the right is known as the settlor the party to whom the right is entrusted is known as the trustee the party for whose benefit the property is entrusted is known as the beneficiary.

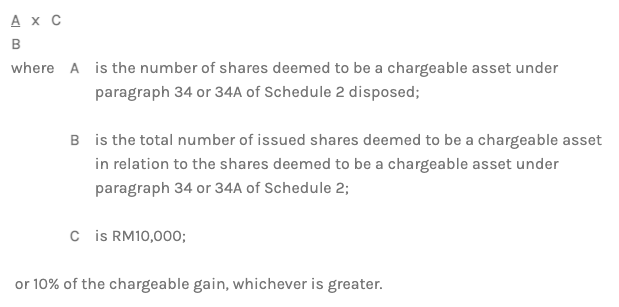

Income Tax or Real Property Gains Tax. Section 4a Income Tax Act 1967 ITA 1967 Real Property Gains Tax Act 1976 RPGTA 1976 SDSB 2 ors V Ketua Pengarah Hasil Dalam Negeri. Then theres another revision to the RPGT under Budget 2020 as well as the Exemption Order for 2020.

It was subsequently legalised via an Act of the UK Parliament in 2019 Passing a ban on conversion therapy. A trust is a legal relationship in which the holder of a right gives it to another person or entity who must keep and use it solely for anothers benefit. The e-filing requirement is generally effective for tax years beginning after July 1 2019.

Senate by Governor Jon Corzine and chaired the United States Senate Committee on Foreign Relations from 2013 to. Robert Menendez m ɛ ˈ n ɛ n d ɛ z. In 2014 the RPGT was increased for the fifth straight year since 2009.

United States 389 U. Real Property Gains Tax RPGT 2020 is a form of Capital Gains Tax that is imposed on the disposal of property in Malaysia. The original Social Security Act was enacted in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance.

The vote was then carried into the Senate. It was founded on April 1 1971 exactly six months before the opening of Magic Kingdom at Walt Disney World Resort in Bay Lake Florida just outside of. A wealth tax also called a capital tax or equity tax is a tax on an entitys holdings of assets.

64 Public Law 115-123 115th Congress An Act To amend title 4 United States Code to provide for the flying of the flag at half-staff in the event of the death of a first responder in the line of duty. Skip to main content. Text for HR748 - 116th Congress 2019-2020.

10716 901 which was repealed by Pub. 1 nationwide service of subpoenas. 1976 Code Section 62-7-602e.

115th Congress Public Law 123 From the US. Income-tax Amendment Act 1976 1 of 1976 Payment of Bonus Amendment Act 1976 23 of 1976. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v.

Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesIn 2020 taxes collected by federal state and local governments amounted to 255 of GDP below the OECD average of 335 of. This includes the total value of personal assets including cash bank deposits real estate assets in insurance and pension plans ownership of unincorporated businesses financial securities and personal trusts a one-off levy on wealth is a. B is a mortgage on real or personal property.

12 of 2020. The Amendment passed by two-thirds of the House with only one vote to spare. The United States of America has separate federal state and local governments with taxes imposed at each of these levels.

Allows an income tax deduction for mortgage interest and real property taxes where a parsonage allowance or a military housing allowance has been received. Amendments Related to Title I of the Act - Permits a taxpayer to elect to have the amendment of the Tax Reform act of 1984 that defers the finance lease rules apply to any agreement. Congress An Act To amend the Internal Revenue Code of 1986 to repeal the excise tax on high cost employer-sponsored health coverage.

While a trust is revocable rights of the beneficiaries are subject to the control of and the duties. Again President Wilson made an appeal but on September 30 1918 the amendment fell two votes short of the two-thirds necessary for passage 53-31 Republicans 27-10 for Democrats 26-21 for. Get the latest international news and world events from Asia Europe the Middle East and more.

A member of the Democratic Party he was first appointed to the US. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The Winter of Discontent was the period between November 1978 and February 1979 in the United Kingdom characterised by widespread strikes by private and later public sector trade unions demanding pay rises greater than the limits Prime Minister James Callaghan and his Labour Party government had been imposing against Trades Union Congress TUC.

In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration SSA. Case Report Judicial Review. For tax years beginning after July 1 2019 under the Taxpayer First Act organizations are required to file certain returns electronically including Form 990 990-EZ 990-PF 8872 and 990-T.

In 2019 the RPGT rates have been revised.

Finance Bill 2021 Proposed Amendments To The Real Property Gains Tax Act 1976 Lexology

Real Property Gains Tax Part 1 Acca Global

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Real Property Gains Tax Act 1976 Amendment 2019 Madalynngwf

What Can A President Do During A State Of Emergency The Atlantic

Social Security United States Wikipedia

Top Ten Estate Planning And Estate Tax Developments Of 2021 The American College Of Trust And Estate Counsel

Inflation Adjusting State Tax Codes A Primer Tax Foundation

Real Property Gains Tax Rpgt Guide For The Year 2020 2021 In Malaysia

Real Property Gains Tax Act 1976 Amendment 2019 Madalynngwf

2019 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

Real Property Gains Tax Rpgt In Malaysia 2022

Real Property Gains Tax Act 1976 Savannagwf

New York Budget Gap Options For Addressing New York Revenue Shortfall

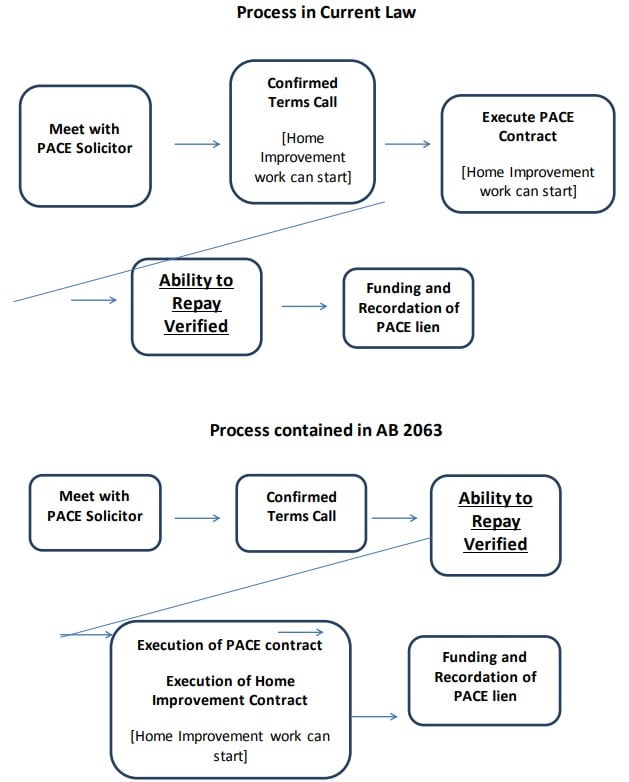

Amendments To The Stamp Act 1949 And Real Property Gains Tax Act 1976 Shearn Delamore Co

0 Response to "real property gains tax act 1976 amendment 2019"

Post a Comment